Limitations and Trade-Offs in DeFi Cross-Chain Bridges: Discussing the Constraints and Compromises Involved in Achieving Interoperability

- Cary

- June 19, 2023

- Defi

- Blockchain, DeFi

- 0 Comments

In the rapidly evolving world of decentralized finance (DeFi), one of the key challenges that developers and users face is achieving interoperability across different blockchain networks. DeFi cross-chain bridges play a crucial role in enabling the seamless transfer of assets and data between these networks. However, like any technology, these bridges come with their own set of limitations and trade-offs. In this article, we will explore the constraints and compromises involved in achieving interoperability in DeFi cross-chain bridges.

As the DeFi space continues to evolve, developers and researchers are actively working on overcoming the limitations and optimizing the trade-offs in DeFi cross-chain bridges. Scalability solutions, such as layer 2 protocols like sidechains and state channels, can help alleviate congestion and improve transaction throughput. These techniques enable off-chain transactions while still ensuring the security and integrity of assets on the main chain.

Moreover, advancements in consensus mechanisms, such as proof-of-stake (PoS) and sharding, hold promise for enhancing the scalability and efficiency of cross-chain bridges. PoS allows for faster block validation and reduces the energy consumption associated with traditional proof-of-work (PoW) consensus. Sharding, on the other hand, partitions the blockchain into smaller, manageable pieces, enabling parallel processing and improving overall network performance.

Security remains a paramount concern in DeFi cross-chain bridges. Developers are exploring innovative cryptographic techniques, such as zero-knowledge proofs and multi-party computation, to enhance the privacy and security of transactions across chains. These techniques enable secure validation and transfer of assets without revealing sensitive information to external parties.

To optimize the trade-off between decentralization and efficiency, hybrid approaches are being explored. These approaches combine the benefits of decentralization with off-chain processing or layer 2 scaling solutions to achieve faster transaction speeds and lower fees. By striking a balance between decentralization and efficiency, developers can ensure a seamless user experience while preserving the fundamental principles of DeFi.

In conclusion, DeFi cross-chain bridges offer immense potential for achieving interoperability between blockchain networks. However, they come with their own set of limitations and trade-offs. Scalability challenges, security concerns, and the balance between decentralization and efficiency all require careful consideration and ongoing research. By addressing these constraints and optimizing trade-offs, we can pave the way for a more interconnected and inclusive DeFi ecosystem that benefits users worldwide.

Introduction

Decentralized finance has revolutionized the financial industry by offering open, permissionless, and trustless financial services powered by blockchain technology. However, the lack of interoperability between different blockchains has hindered the full potential of DeFi. DeFi cross-chain bridges aim to address this issue by creating connections between disparate blockchain networks, allowing assets and data to flow freely.

Understanding DeFi Cross-Chain Bridges

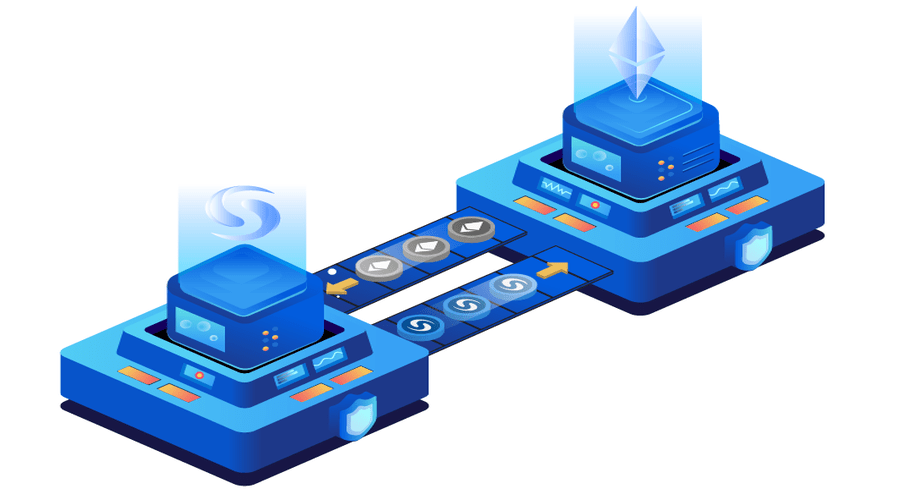

DeFi cross-chain bridges are protocols or systems that enable the transfer of assets and data between different blockchain networks. These bridges act as intermediaries, facilitating the seamless exchange of tokens or other digital assets across various chains. They achieve this by locking assets on one chain and minting corresponding tokens on the target chain, ensuring that the value remains intact during the transfer process.

Limitations of DeFi Cross-Chain Bridges

While DeFi cross-chain bridges provide a valuable solution for interoperability, they are not without their limitations. Here are some of the key constraints that developers and users need to consider:

Scalability Issues

As DeFi continues to gain popularity, scalability remains a major challenge for cross-chain bridges. The high demand for transferring assets between chains can lead to congestion and delays. The scalability limitations of individual blockchains can impact the overall performance of cross-chain bridges, potentially affecting transaction speed and efficiency.

Security Concerns

Maintaining robust security across multiple blockchain networks is a complex task. Cross-chain bridges require secure mechanisms for asset locking, token minting, and transfer validation. However, vulnerabilities in any of these processes can lead to potential security breaches and asset theft. Ensuring the highest level of security is crucial to maintain user trust and protect the integrity of the DeFi ecosystem.

Centralization Risks

Some cross-chain bridges rely on a centralized approach to achieve interoperability. While this may provide certain benefits, such as faster transaction speeds, it also introduces centralization risks. Centralized bridges can become single points of failure, making them vulnerable to attacks or manipulation. Balancing the benefits of centralization with the principles of decentralization is a critical consideration in the design and implementation of cross-chain bridges.

Trade-Offs in DeFi Cross-Chain Bridges

Achieving interoperability in DeFi cross-chain bridges often requires trade-offs in various aspects. Here are some of the key trade-offs that developers and users must evaluate:

Performance vs. Security

Enhancing performance by optimizing transaction speed and throughput can sometimes come at the expense of security. The trade-off between performance and security is a delicate balance that developers must carefully consider. Striking the right balance ensures that cross-chain bridges can handle a high volume of transactions without compromising the integrity and safety of the assets being transferred.

Decentralization vs. Efficiency

DeFi thrives on the principles of decentralization, empowering individuals and eliminating intermediaries. However, achieving full decentralization in cross-chain bridges can introduce inefficiencies in terms of transaction speed and cost. Developers must navigate this trade-off by finding ways to strike a balance between decentralization and efficiency to provide users with a seamless experience without compromising security.

User Experience vs. Complexity

Simplifying the user experience is crucial for mass adoption of DeFi cross-chain bridges. However, implementing a user-friendly interface and intuitive processes can be challenging when dealing with complex technical aspects, such as blockchain protocols and cross-chain communication. Developers must find ways to strike a balance between simplicity and the underlying complexity to ensure accessibility for both novice and experienced users.

Overcoming Limitations and Optimizing Trade-Offs

Despite the limitations and trade-offs involved, continuous innovation and research in the field of DeFi cross-chain bridges can help overcome these challenges. Improving scalability through layer 2 solutions and exploring novel consensus mechanisms can enhance the overall performance of cross-chain bridges. Implementing advanced cryptographic techniques and robust security measures can strengthen the security infrastructure. Additionally, striking a balance between decentralization and efficiency requires constant refinement of protocols and mechanisms.

- Scaling Solutions: Implementing layer 2 scaling techniques like sidechains and state channels can alleviate scalability issues by enabling off-chain transactions and reducing congestion on the main chain.

- Advanced Consensus Mechanisms: Exploring innovative consensus mechanisms such as proof-of-stake (PoS) and sharding can enhance scalability and efficiency, allowing for faster block validation and parallel processing of transactions.

- Robust Security Measures: Implementing advanced cryptographic techniques like zero-knowledge proofs and multi-party computation can strengthen the security infrastructure, ensuring the privacy and integrity of transactions across chains.

- Hybrid Approaches: Adopting hybrid approaches that combine decentralization with off-chain processing or layer 2 solutions can strike a balance between efficiency and decentralization, offering faster transaction speeds and lower fees.

- Research and Development: Continuously investing in research and development efforts to address limitations and improve cross-chain bridge technology is crucial for driving innovation and finding new solutions.

- Community Collaboration: Encouraging collaboration and knowledge-sharing among developers, researchers, and the broader community can foster collective problem-solving and lead to more robust cross-chain bridge solutions.

- User Education: Providing educational resources and guidelines to users about the risks and best practices when using cross-chain bridges can help ensure the safety of their assets and promote responsible usage.

- Auditing and Security Reviews: Conducting regular security audits and reviews of cross-chain bridge protocols can identify vulnerabilities and enhance the overall security of the system.

- Regulatory Compliance: Navigating the regulatory landscape and ensuring compliance with relevant laws and regulations can foster trust and legitimacy in the DeFi ecosystem, encouraging wider adoption.

By implementing these strategies and continuously improving upon existing solutions, the limitations of DeFi cross-chain bridges can be overcome, and the trade-offs can be optimized, leading to a more efficient, secure, and interconnected decentralized finance ecosystem.

Conclusion

DeFi cross-chain bridges play a pivotal role in achieving interoperability between blockchain networks, enabling the seamless transfer of assets and data. However, it is important to acknowledge the limitations and trade-offs involved in the pursuit of this goal. Scalability issues, security concerns, and centralization risks pose challenges that require careful consideration. Striking the right balance between performance and security, decentralization and efficiency, and user experience and complexity is essential. By addressing these challenges and optimizing trade-offs, we can pave the way for a more interconnected and robust DeFi ecosystem.

FAQs

Q1: Can DeFi cross-chain bridges be used with any blockchain network?

Yes, DeFi cross-chain bridges can be designed to connect different blockchain networks, allowing the transfer of assets and data between them.

Q2: Are there any risks associated with using cross-chain bridges in DeFi?

While cross-chain bridges offer interoperability, they come with risks such as scalability issues, security vulnerabilities, and centralization risks. Users should carefully evaluate these factors before engaging with cross-chain bridges.

Q3: How can developers overcome the scalability challenges of cross-chain bridges?

Developers can explore solutions like layer 2 scaling techniques, such as sidechains or state channels, to improve the scalability of cross-chain bridges.

Q4: Are decentralized cross-chain bridges more secure than centralized ones?

Decentralized cross-chain bridges aim to provide a higher level of security by removing central points of failure. However, both decentralized and centralized bridges have their own security considerations that need to be addressed.

Q5: How can users ensure the safety of their assets when using cross-chain bridges?

Users should conduct thorough research and due diligence on the cross-chain bridge they intend to use. They should also follow best practices such as verifying the bridge’s security measures, understanding the token transfer process, and using secure wallets to store their assets.