Get Started Now | FinTax Officially Supports Crypto Assets Tax Reporting in Australia

- summy Morphe

- August 14, 2024

- Press release

- 0 Comments

Are you troubled by the difficulty of managing dispersed crypto assets? Are you stuck because of the complexity of filing crypto assets? Are you worried about visualizing the cost, profit and loss of your crypto assets? FinTax can take the worry away!

FinTax is officially launched in the Australian market to meet your crypto asset management and tax reporting needs with preferential prices and various functions! Limited time discounts, up to $50 off: Base subscription, originally priced at $35, is now $25 for a limited time! Prime subscription, originally priced at $69, is now $49 for a limited time! Ultra subscription, originally priced at $179, is now $129 for a limited time!

FinTax platform, FinTax Metamask Snap and FinTax Telegram Mini-App now fully support crypto assets management and tax reporting services for individual users in Australia. You can import, manage and report assets on major exchanges and wallets with one click. In addition, FinTax, as the first crypto asset management and tax management software that supports the BTC

ecosystem, can help you easily manage and report ordinals, runes, atomicals, and generate Australian tax forms and tax drafts: Click here to try for free.

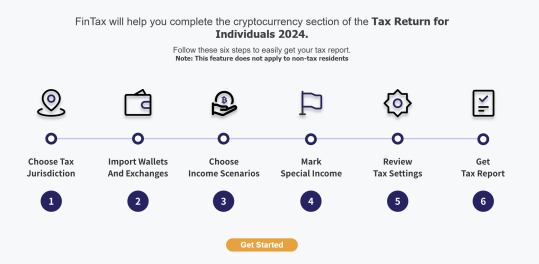

How to Use FinTax for Tax Reporting

For Australian users, completing tax calculations with FinTax is simple and straightforward. Follow these steps:

Step 1: Import Wallet and Exchange Data

Simply enter your on-chain wallet address and exchange API (FinTax strictly protects user data, so ensure you enter a Read-Only API). Wait for the data import to complete. FinTax supports data import from dozens of major exchanges and wallets.

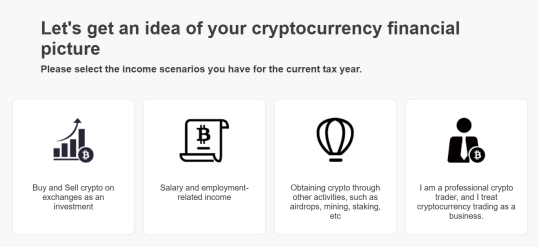

Step 2: Select Cryptocurrency Income Types

FinTax categorizes the income you derive from cryptocurrencies into four types. You can choose according to your actual situation, and FinTax will match the most suitable tax treatment method for your cryptocurrency assets.

Step 3: Mark Special Transactions

If you are a professional cryptocurrency trader or receive salary income in the form of cryptocurrencies, you need to mark these special transactions for proper tax calculation. FinTax provides a comprehensive process guide to help you review these special transactions.

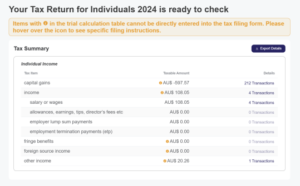

Step 4: Complete and Export Tax Reports

You can optimize your tax burden by choosing the first-in, first-out (FIFO), last-in, first-out (LIFO), or weighted average method. You will find the various items provided by FinTax in the Australian government’s myTax program or on paper tax returns. If you have other income, remember to aggregate your cryptocurrency income with other income before reporting. You can also provide FinTaxs tax report to your accountant.

The tax calculation results on the FinTax platform are verified by our professional tax team and are highly consistent with the official policies of the Australian government. Additionally, FinTax places great emphasis on data security, strictly enforcing privacy protection policies. The data you import is encrypted through algorithms and remains completely anonymous.

FinTax Personal Edition Services

FinTax offers personalized financial and tax services tailored to your tax jurisdiction:

Financial Management: Easily import your cryptocurrency transactions anonymously from major exchanges and digital wallets. The system will generate an asset dashboard for you, providing functions such as asset balance monitoring and profit/loss calculations.

Tax Filing: FinTax automatically generates compliant cryptocurrency tax forms based on your tax jurisdiction, simplifying your tax filing process. Additionally, you will be able to access local tax policies within FinTax in the future.

Whether youre a novice or an experienced professional, FinTax serves as your dedicated cryptocurrency financial and tax advisor, saving you time and making complex tax issues manageable.

About FinTax

FinTax provides professional crypto asset financial and tax management services to users worldwide. As the principal of TaxDAO, FinTax was founded by former Bitmain tax director Calix and his expert team, who possess extensive experience in Web3 financial and tax management.

FinTax has secured angel investments from industry leaders and leading institutions and is currently undergoing Seed-round financing.

FinTax offers comprehensive service support across major compliant regions worldwide. No matter where you conduct your business, FinTax can provide you with professional financial management and tax reporting services. Experience FinTax, FinTax Metamask Snap and FinTax Telegram Mini-App today to simplify and enhance your crypto assets financial and tax management.