Choosing the Right Blockchain for Payments: A Comparative Analysis

- summy Morphe

- March 13, 2025

- Press release

- 0 Comments

TL;DR

- The payments industry is evolving, with traditional finance processing millions of TPS while crypto adoption faces regulatory and scalability challenges.

- Scalability remains a major hurdle, as L1 networks struggle with low TPS, while L2 solutions like Lightning, INTMAX, and Arbitrum aim to improve transaction throughput.

- L1 and L2 solutions differ in trade-offs, with Stellar and Ripple focusing on institutional finance, while Lightning, INTMAX, and Arbitrum enhance crypto-native payments.

- The future of blockchain payments depends on adoption, compliance, and scalability, with different blockchains competing to become the dominant global payments network.

Introduction

With crypto innovation on the rise, how do users know which of the payment systems is likely to be used most during crypto adoption? What factors are important in evaluating which blockchain is the “right” blockchain for payments? These are not easy questions to answer, but this article will work to cover the evolving needs of the most prevalent payment contenders, evaluation criteria to keep in mind while investing, and a comparative analysis of both L1 and L2 network solutions to this problem. To establish a path forward in this discussion, it is necessary to understand how the payments industry has evolved in crypto including regulatory challenges, scalability, and present day solutions.

The Payments Industry’s Evolving Needs

In the world of Traditional Finance (TradFi), our payments industry has been largely characterized by millions of transactions per second (TPS) across the global economy between such industry giants as Visa, Mastercard and more recently with applications like Venmo and CashApp. These tools have allowed for banks across the globe to have interconnected liquidity, making for incredible investment opportunities, cost efficiencies, and essentially borderless transactions.

With the onset of crypto, these characteristics have been different. TPS on-chain is extremely low in the case of L1 solutions like Bitcoin or Ethereum while L2 solutions bring some scalability but lack the overall architecture to sustain global scalability to date. Additionally, because of the nature of crypto’s pseudo-anonymous blockchain, many institutional entities like central and regional banks and government regulatory bodies have trouble ensuring global compliance for Anti-Money Laundering (AML) and Know-Your-Customer (KYC) legal requirements. Furthermore, some nation-states use crypto as a work around from SWIFT mandated sanctions in order to sustain monetary inflows during political turbulence. As a result of these concerns, crypto adoption has been difficult to rally since the larger powers of the payments industry see crypto as more of a disruption rather than a solution.

These TradFi entities are in the process of re-working this institutional thinking as more and more countries and companies institute crypto reserves on Bitcoin, or use Ethereum smart contracts to track inventories across shipment itineraries. As a result, the payments industry is scrambling to support growing adoption of crypto and blockchain more broadly as developers on L1 and L2 networks seek to solve the scalability challenges associated with this new financial technology. As we progress on this timeline, there will be a unique moment in the future where blockchain scalability solutions will converge with the institutional adoption rates for a (hopefully) smooth transition into a new financial system characterized by Bitcoin, Ethereum, Stellar, or Ripple instead of Visa, Mastercard and Venmo.

The Scalability Challenge & Blockchain Solutions

The scalability challenge that exists on L1 networks like Bitcoin and native Ethereum are directly related to Data Availability (DA). Today, L1 networks are designed to have consensus mechanisms that require nodes to validate and store all the transactions that exist on-chain. Since the chains are immutable, they become longer over time, requiring more and more updates to the global state of the chain while additional memory is a scarce resource. This long-winded consensus mechanism is great for chain security, but makes it difficult for any chain to obtain more than 20 TPS. There are additional concerns that complicate this issue, including higher computational requirements, network congestion, transaction fees, and hardware limitations all of which impact this issue either on the backend or the frontend of the problem.

Enter the L2. L2s work to enhance scalability of L1 networks in a variety of ways, leveraging different types of technology to help shrink the DA problem, and thus broaden the horizons of what is possible on-chain. There are various examples of L2s that do this work; on Bitcoin, the Lightning Network does much of this heavy lifting, while on Ethereum, INTMAX and Arbitrum both work to solve the problem in their own unique ways. Other L1s take an entirely different approach to this issue much like Stellar and Ripple (XRP Ledger), in hopes to beat out Ethereum and Bitcoin, respectively. With so many options, how does the payments industry assess whether a new L1 like Ripple or Stellar is a viable option for scalability compared to L2 solutions like Lightning Network, INTMAX, and Arbitrum?

Scope of the Study: L1 Networks

Stellar

To effectively answer this question, an investor and the payments industry more generally needs to have a deeper understanding of these technologies, how they are built, and the inherent costs and benefits associated with each of them. Since it has been established that both Bitcoin and Ethereum on their own are nonstarters for scalability, an analysis of Stellar and Ripple is a reasonable place to begin for this discussion.

In 2014 Jed McCaleb and the Stellar Development Foundation (SDF) were working to improve global finance through the provision of fast, low-cost, cross border transactions by connecting banks, people, and payment processors. The native token on Stellar, Lumens (XLM) is used to process transaction fees much like Ether on Ethereum. However, as a protocol, Stellar operates differently than Ethereum in that it implements a consensus mechanism called the Stellar Consensus Protocol (SCP). SCP uses a Federated Byzantine Agreement (FBA) model. The FBA allows network participants to validate transactions through the creation of “quorum slices” whereby trusted groups can collectively reach consensus on transactions, allowing for a 2-5 second verification speed. This allows Stellar to leverage an impressive 1,000 TPS.

Though this TPS dwarfs Bitcoin and Ethereum, it is far under the necessary requirements for global payments today. However, Stellar has features that make it unique, including a built in Decentralized Exchange (DEX), automatic currency conversion, asset issuance, and institutional anchors like banks and payment processors to bridge TradFi onto the Stellar platform.

Ripple

Ripple was developed and launched by Ripple Labs in 2012 with the same aims as Stellar did later in 2014; fast, low-cost, cross border payments. The main difference between the two is that Ripple worked closely with institutional players like banks, financial institutions, and payment providers alike as a means to modernize the present financial system. Ripple’s native currency is XRP, which serves as a currency to bridge with existing currencies to instantiate value transfer across fiat and crypto.

Similar to Stellar, Ripple also uses its own unique consensus model, referred to as a Unique Node List (UNL) where transactions are verified by a selected group of institutional and individual validators. Since no mining is required, this makes Ripple eco-friendly, which satisfies resource constraints likely in the future, though it is highly centralized as it was created with TradFi in mind. Allowing banks and financial institutions direct access to verification procedures, transactions are verified quickly (typically under 5 seconds), which yields a TPS of approximately 1,500.

Additionally, Ripple also offers RippleNet, an enterprise solution for global transactions through its various products, including xCurrent, xRapid, and xVia. xCurrent allows for real-time institutional settlement while xRapid provides instantaneous currency exchange, and xVia is the payment platform for institutions to move money quickly across borders. What XRP has that Stellar doesn’t, is a tarnished reputation after a long-winded battle with SEC lawsuits that have recently ended. This reputational damage has negatively impacted Ripple’s global adoption since its inception in 2012, where today it trades at a mere $2.46. This valuation however, is still much higher than Stellar Lumens which at the time of this writing is trading at $0.33.

Though these solutions offer similar services, they do have small divergences in application, centralization, liquidity, and reputation, each of which are necessary to evaluate when working to determine which of them is the “right” blockchain solution to expand global adoption in the payments industry.

Scope of the Study: L2 Networks

L2 Networks are a different story altogether as these each have totally unique implementations, use cases, native chains, taxonomies, and architectures associated with them. For the purpose of this article, the most promising L2 solutions are likely Lightning Network on Bitcoin, and INTMAX and Arbitum on Ethereum. Instead of L1 settlement of individual transactions being processed one at a time, L2 projects batch transactions together and commits that one batch to the L1 for settlement. This technology implementation unlocks scalability that Stellar and Ripple are not yet capable of doing, where tens of thousands of transactions are processed per second as opposed to less than two thousand. L2s allow blockchain technology to get as close as it has to-date to the ever lauded Visa and Mastercard TPS numbers. This makes L2s a promising innovation in the race for global crypto adoption.

Lightning Network

Since it is always good to start with a classic, beginning the L2 discussion with Bitcoin’s Lightning Network seems appropriate. The Lightning Network was suggested by Joseph Poon and Thaddeus Dryja in 2015, for the purpose of processing transactions off-chain before settlement on the Bitcoin L1. This strategy would allow for microtransactions on the Lightning Network in the millions of TPS, unlocking Bitcoin scalability.

The Lightning Network uses a multi-sig Bitcoin address that is signed by two users that pool Bitcoin liquidity together. This is known as opening a “channel” between users. Once both users send Bitcoin to the shared address, the transaction is broadcasted to the Bitcoin network and the funds are locked into the channel. This allows users to transact between each other with the allotted monies on the shared address without needing to settle on the Bitcoin L1 until the channel is “closed” where the ledger is balanced and a final transaction is settled on-chain to the individual holders. This solution offers tons of privacy, millions in TPS, with near zero fees.

This option does have inherent challenges though, for all its bluster, the Lightning Network requires that liquidity be created within the channel first, limiting individual financial sovereignty on the network. Furthermore, there are routing channels that have significant liquidity, which leads some to conclude that there are centralization concerns. Finally, if two users open a channel and one doesn’t want to close it, there can be increased latency due to unresponsiveness from a user, leaving funds locked in a channel for longer periods of time. Thankfully, users can still force-close these channels in this case, but the latency concern remains as it could take an hour or longer based on network congestion for a user’s funds to become available upon force closing a channel.

INTMAX

Alternatively, INTMAX is a stateless L2 built on the Ethereum blockchain. Launched by co-founder Leona Hioki back in 2021. After extensive research, the INTMAX team discovered they can implement a stateless L2 architecture using Zero-Knowledge Proofs (ZKPs) and rollup technology. This implementation allows a batch of transactions to be settled on the Ethereum chain after each of them has been encrypted using ZKPs. This makes thousands of transactions only 5 bytes once rolled up and settled on the L1. This ingenious solution puts the DA problem in the hands of users through the implementation of ZKPs on the client-side. As such, INTMAX offers approximately 80,000 TPS though this implementation is likely to be near infinite, with transaction fees consistently low at about $0.05.

INTMAX also has a unique security architecture where users participate in “privacy mining,” where a user stakes ETH on the INTMAX network and receives ITX as a reward for doing so, which expands the INTMAX Anonymity Set. Once the ETH is deposited, the origin of the ETH is obscured, enhancing user privacy across the network. For 0.1 ETH, a user can deposit funds and begin to participate in ensuring the privacy of the users on this stateless L2, earn rewards, and participate in the greatest TPS solution on the market today.

The downside of INTMAX is that it’s currently in the testnet phase. However, the INTMAX mainnet is set to launch soon, especially after glowing reviews from researchers on the Nethermind team. INTMAX has also gotten recognition from Vitilak Buterin for its innovative approach to scalability in his blog when he said, “in the Intmax case, you get a very high level of scalability and privacy.” Is INTMAX the future? We will see when the mainnet launches later this year.

Arbitrum

Our last L2 is an equally interesting case. Similar to INTMAX, Arbitrum also leverages rollup technology, but uses the Optimistic rollup strategy. This means that every transaction on Arbitrum is considered valid unless otherwise specified by another user. These transactions are processed by off-chain validators, batched and then posted to the Ethereum blockchain. If there is suspicious activity, a user can submit a “fraud proof” to challenge a transaction and Ethereum adjudicates the dispute. Arbitrum offers an impressive 40,000 TPS scaling solution and its ecosystem is rife with great features and a burgeoning ecosystem.

A stand-alone feature of Arbitrum is that it is EVM and smart contract compatible, allowing developers to easily migrate dApps to the L2. Arbitrum also supports a variety of dApps that are likely to be familiar, including UNISWAP, the decentralized exchange; AAVE, the lending service; and OpenSEA, the NFT Marketplace. Arbitrum also has a variety of chains for differing use cases, notably Arbitrum Nova for gaming and social media along with Arbitrum Orbit, and L3 for developers to build customized rollups.

Key Evaluation Criteria

Given the in-depth evaluation of each of these L1 and L2 solutions respectively, which of them is likely to be the outsized winner when it comes to future adoption and therefore be accepted as the new global payments system? It’s likely too early to tell, but some evaluation criteria can be analyzed to help a user make an educated prospectus of these options.

1.Scalability & Transactions Per Second (TPS)

First and most obvious is the scalability and transaction throughput that will support a global financial market. How many transactions can a blockchain handle? What scalability enhancements are both possible and impossible given the basic construction of the L1 platform? How difficult would it be to generate a hard-fork that is acceptable to the public and that could support the necessary changes required for such a global payments system? These questions are both necessary to ask and paramount to have viable answers for when deciding which option has the best chance of success.

2.Transaction Costs & Efficiency

The next consideration that should be investigated is the transaction costs and efficiency of on and off ramps for fiat conversion of a given currency. This is primary to evaluate as transactions that are too costly will mean less transactions overall. Transaction fees, or gas fees and how they affect various business models both on and off chain will determine the usability of a particular chain in the aggregate. Furthermore, cost effectiveness of fiat conversion is a huge consideration as any crypto currency is first generated through the conversion of fiat money and will continue to be as more and more users are onboarded over time.

3.Speed & Settlement Finality

In a world of global transactions, not only are cost and scalability concerned, but time and finality are crucial as well. Block confirmation times showcase how quickly a transaction can be finalized on-chain. As such, they speak to the overall speed of the chain to do finance on a global scale. Debit card transactions are typically finalized within seconds, settled on the bank ledger. Transactions on blockchain need to be just as fast, lest we all stand for ten minutes for a block to confirm our transaction at the gas station. Not very efficient. The network also needs to be robust enough that there is limited downtime history and performance consistency to ensure settlement and finality of transactions. Any chain that falters is a chain that is unreliable. So when looking for a blockchain, make sure to find one that has a limited history of downtime and outages.

4.Security & Regulatory Compliance

Another pivotal point of consideration is overall blockchain security and its alignment with regulatory compliance and legal considerations. Blockchains must have a limited risk of censorship, fraud, and security breaches to be considered for the global payments as censorship could limit access to financial resources, a requirement for global payment systems. Although its required to ensure that everyone has access to the same system, its equally important to limit illegal activity in finance, which means that KYC and AML regulation must be adhered to in order for a chain to be effective for the future of finance.

5.Adoption & Ecosystem Support

The next thing users should consider when evaluating blockchains for the future of finance is adoption and ecosystem support. Traditional financial institutions and fintech adoption rates demonstrate the overall support a particular chain has, showcasing approval from the financial populace. Furthermore, developer and enterprise support for payments highlights ecosystem support for a chain. Without adoption and ecosystem support a chain will be unsustainable.

Comparative Analysis of Leading Blockchains for Payments

Layer 1 (L1) Blockchains for Payments

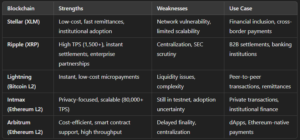

Stellar (XLM)

Strengths:

- Low-cost

- Fast remittances

- Institutional adoption

Weaknesses:

- Network vulnerability

- Inflation rate mechanism

Use Case: Connecting financial institutions for those unbanked and underbanked individuals, particularly in developing countries and facilitates cross-border payments.

Ripple (XRP Ledger)

Strengths:

- High TPS (1,500+)

- Instant settlements

- Enterprise partnerships

Weaknesses:

- Centralization concerns

- Regulatory challenges

Use Case: Works to align B2B settlements, banking institutions, and reinforce remittances across borders.

Layer 2 (L2) Scaling Solutions for Payments

Lightning Network (Bitcoin L2)

Strengths:

- Instant

- Low-cost micropayments

Weaknesses:

- Network reliability due to lack of liquidity

- Complexity

Use Case: Offers peer-to-peer micropayments for retail and cross border transactions

Intmax (Ethereum L2)

Strengths:

- Privacy-focused rollup

- Scalable

Weaknesses:

- Adoption and ecosystem

- Regulatory scrutiny

Use Case: Provides private transactions across financial institutions and people to facilitate cross-chain interoperability and cross border payments

Arbitrum (Ethereum L2)

Strengths:

- Cost-efficient

- High throughput

- Ethereum compatibility

Weaknesses:

- Delayed finality

- Centralization

- Scalability limitations

Use Case: Faster transactions using smart contracts for retail and enhance scalability of dApp applications

Conclusion & Recommendations

Choosing which chain is ultimately the best for global blockchain payments in the future is a daunting task. Although there are many viable options, only one chain can win out in the end. The best blockchain for global payments will depend on the overall needs of enterprises and banks, where Ripple and Stellar are likely best suited. It will also require crypto-native payments where Lightning and Arbitrum are leading contenders. Finally, privacy is a main concern for global payments in the future, protecting businesses and individuals from political turmoil, necessitating a chain like INTMAX to win out in the end. Regardless of which chain is the winner moving forward, whether an L1 or and L2 payment system, blockchain is here to stay and users should work to remain informed on the changes and nuances of this choice as this industry evolves.

References:

Arbitrum Explained: A Web3 User’s Guide to the Innovative L2:

https://www.bitpay.com/blog/arbitrum-user-guide

INTMAX’s stateless blockchain: Leona Hioki’s vision for privacy, scalability, and decentralization:

Cross-Rollup dApps and the Future of Blockchain Interoperability with INTMAX:

https://hackernoon.com/cross-rollup-dapps-and-the-future-of-blockchain-interoperability-with-intmax

Real-world use cases for the Lightning Network:

https://bakkt.com/blog/lightning-network-real-world-use-cases

Omnibolt and Lightning Network: unlocking the future of cryptocurrency transactions:

Top 5 Blockchain Scalability Solutions for 2024:

https://blog.bake.io/top-5-blockchain-scalability-solutions-for-2024/?utm_source

Brief Guide to Blockchain Scalability Solutions:

https://www.lcx.com/brief-guide-to-blockchain-scalability-solutions/

Advancing Blockchain Scalability: An Introduction to Layer 1 and Layer 2 Solutions:

https://arxiv.org/abs/2406.13855?utm_source

Stellar is Where Blockchain Meets the real world:

Ripple and Stellar: Pioneers in Blockchain Utility:

https://medium.com/%40ceelo92/ripple-and-stellar-pioneers-in-blockchain-utility-d465583e20d8